Mutual Funds for Beginners: A Simple Guide to Start Investing

Investing in mutual funds is one of the easiest and most effective ways to grow your money. Whether you’re new to investing or just exploring options, mutual funds offer a flexible way to diversify your portfolio, reduce risk, and start building wealth. In this guide, we’ll break down the basics of mutual funds, how they work, and how you can start investing.

What are Mutual Funds?

A mutual fund is a pooled investment vehicle that allows investors to buy shares in a fund that is managed by a professional portfolio manager. The fund collects money from multiple investors and uses it to invest in a variety of securities, such as stocks, bonds, and other assets. This helps spread the risk across different investments, which is ideal for beginners who may not have the knowledge or resources to build a diversified portfolio on their own.

In simpler terms, mutual funds are like baskets filled with different types of investments, and when you buy a share of the fund, you own a small piece of everything inside the basket.

How Do Mutual Funds Work?

Here’s a basic breakdown of how mutual funds operate:

- Pooled Investments: Mutual funds pool money from various investors. The fund is managed by professionals who decide where to invest that money. The investment is done strictly as per the objective of the scheme.

- Diversification: By investing in a range of assets, the risk is spread out, meaning if one investment performs poorly, others may perform better, helping to balance the overall risk.

- NAV (Net Asset Value): The value of a mutual fund’s share is determined by the Net Asset Value (NAV), which is the total value of all assets in the fund divided by the number of outstanding shares. The NAV is calculated at the end of each trading day.

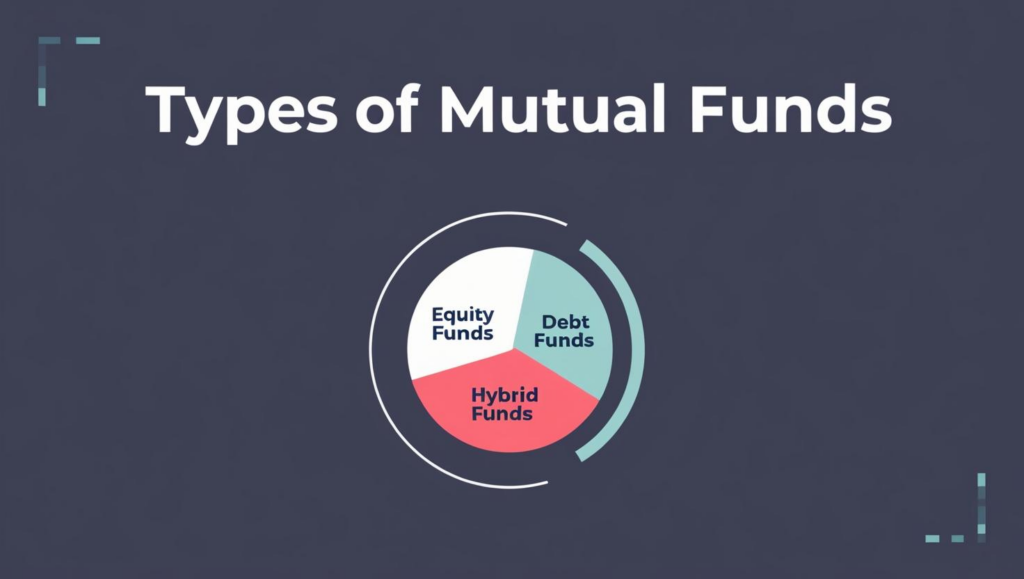

- Types of Mutual Funds: There are several types of mutual funds, each with a different investment strategy and risk profile. These include:

- Equity Funds: Invest primarily in stocks and aim for high returns over the long term.

- Debt Funds: Invest in bonds or other fixed-income securities. They are lower risk compared to equity funds but also offer lower returns.

- Hybrid Funds: Invest in a mix of stocks and bonds to balance risk and return.

- Dividends & Capital Gains: If the mutual fund earns a return through dividends or capital gains, the fund may distribute those earnings to investors, typically on a quarterly or annual basis.

Benefits of Investing in Mutual Funds

- Diversification: Diversifying your investments across different sectors and asset classes reduces the risk of significant losses. Mutual funds inherently offer diversification, even with a small initial investment.

- Professional Management: Mutual funds are managed by professional fund managers who have expertise in analyzing and selecting investments. This takes the guesswork out of investing for beginners.

- Liquidity: Mutual fund shares can be bought or sold on any business day, providing liquidity. This makes it easy to access your money if needed.

- Affordability: Many mutual funds have low minimum investment amounts, making them accessible to beginners with limited capital.

- Automatic Investment Options: Most mutual funds offer systematic investment plans (SIPs), allowing you to invest a fixed amount regularly. This helps build a habit of consistent investing, which is key to long-term wealth accumulation. Investment through SIP reduces the risk through principle of “Cost Rupee Averaging”

Risks of Mutual Funds

While mutual funds offer many benefits, it’s important to be aware of the risks involved:

- Market Risk: The value of the mutual fund may fluctuate based on the performance of the market or specific sectors.

- Management Risk: Poor decisions made by the fund manager can negatively impact the performance of the fund.

- Fees: Mutual funds charge management fees (Adusted in NAV of the scheme), which can vary.

How to Choose the Right Mutual Fund for Beginners

When selecting a mutual fund, consider the following factors:

- Investment Goals: What are you hoping to achieve with your investments? Are you looking for long-term growth or short-term income? Your goals will help determine the type of fund that’s right for you.

- Risk Tolerance: Every investor has a different level of comfort with risk. Equity funds offer the potential for higher returns but come with higher volatility, while debt funds are lower risk but typically offer lower returns.

- Fund Performance: While past performance is not a guarantee of future returns, it can give you an idea of how well the fund has been managed.

- Fund Manager: Research the experience and track record of the fund manager. A skilled manager can make a significant difference in the fund’s performance.

Here are five points regarding security in mutual funds:

- Diversification: Mutual funds invest in a variety of assets (stocks, bonds, etc.), spreading risk across multiple securities. This diversification reduces the impact of any single underperforming asset on the overall portfolio, making them a safer investment option compared to individual securities.

- Regulation and Oversight: Mutual funds are regulated by government bodies such as the Securities and Exchange Board of India ( SEBI). These regulations ensure that mutual funds follow strict guidelines regarding transparency, disclosure, and investor protection.

- Professional Management: Mutual funds are managed by experienced professionals who make investment decisions based on in-depth research and market analysis. This expertise helps mitigate risks and ensures that the fund is properly managed in line with its investment objectives.

- Liquidity: Mutual funds offer high liquidity, meaning investors can buy or sell their shares at the daily net asset value (NAV) price. This ensures that investors have easy access to their money, providing a level of security in terms of access to funds when needed.

- Risk Mitigation through Asset Allocation: Many mutual funds are designed with a balanced approach to risk, using asset allocation strategies that align with investors’ risk tolerance. Whether in equity, bond, or hybrid funds, investors benefit from a structured risk management approach that aims to preserve capital while generating return

How to Start Investing in Mutual Funds

- Set Your Investment Goals: Clearly define your financial goals, such as saving for retirement, buying a home, or building an emergency fund.

- Research Funds: contact a mutual fund distributor to explore the best mutual funds for proper asset allocation.

- Start with SIP (Systematic Investment Plan): SIP allows you to invest a fixed amount regularly. This strategy helps you benefit from Rupee-cost averaging, reducing the impact of market fluctuations.

- Monitor Your Investments: Regularly review your mutual fund investments to ensure they’re still aligned with your financial goals. While mutual funds are long-term investments, it’s important to stay informed.

Conclusion

Mutual funds are an excellent starting point for beginners who want to grow their wealth while minimizing risk. By offering diversification, professional management, and accessibility, mutual funds make it easy for individuals to invest without needing deep expertise. As with any investment, be sure to research your options carefully and invest based on your financial goals and risk tolerance. Remember, investing is a journey, not a sprint, so stay consistent, be patient, and watch your money grow over time. Happy investing!